Insurance needs for entrepreneurs protecting business and personal assets:

Table of Contents

Insurance Coverage Case Study for Personal Financial Planning

Keywords: The social grid, hence contentious space, and competitive nodal) for riders typically mentioning two and three wheeler together.

Tip: Driving’ down the highway on a sunny day, feeling like life is fine Now, imagine a sudden pothole and your car goes flying. Life without a personal financial plan — pretty random and risky. Personal financial planning plays the exact same role as a GPS in your life but it’s for YOUR personal finances…guiding you through and insuring that any benchmarks are met, smoothly if possible! Insurance, acting as the safety net of life’s uncertainties is an important cog in one such plan Importing insurance to stick your financial plan with the help of a story.

This Johnson Family Case Study

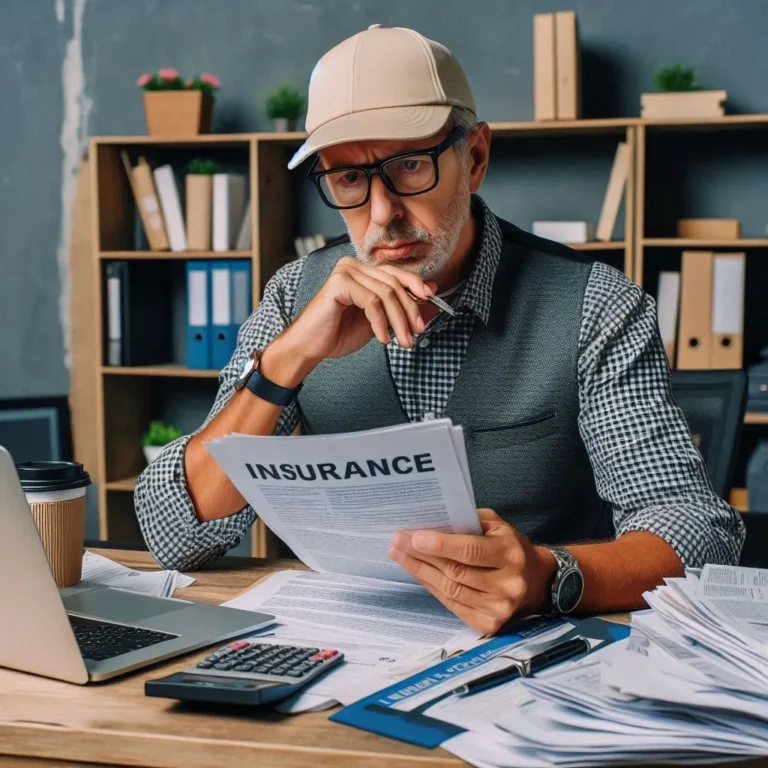

Meet the Johnson: Alex and Jamie, a young married couple with two kids Emma and Jake. The mother and father both work full time trying to gain a semblance of money for the family. Kerry and Ellen have a home, some savings, education plans for their kids But insurance is something they really have not thought through yet.

Fast forward, Alex is the breadwinner and he sustains an injury that puts him out of work for several months. Without a good insurance plan the financial stability of the family is under threat. The expense in hospital bills starts to add up, the savings dry out and anxiety levels shoot through the roof. This situation is a perfect example of why personal insurance should absolutely be considered as part as an entire financial plan.

Types of Insurance: Let Us Get Started

Insurance seems like a complete minefield, break it down! Different areas of your life can be protected by various forms of insurance. Health Insurance — Covers costs related to medical care Life insurance — Financial support for dependent in the event of your death Disability income protection: Replaces a portion of your Income if you are unable too work Homeowners or renters insurance will be wise due to the significant goods and valuables you have, while auto car insuring your vehicle.

In the case of the Johnson, disability insurance would have helped cushion some of that financial blow during Alex’s recovery and simply underlines just how important it is as a component in an all encompassing financial plan.

Executing an Insurance Plan

Developing an insurance plan includes evaluation of your requirements, studying the available options and selecting appropriate policies. Determine the risk – First, you should assess your financial situation and proactively identify potential risks. If you got sick or hurt and could no longer work, what would happen? If a natural disaster struck your home down to specks of dust… then how]? You can then move on to looking at different types of insurance policies that are available, as well as the standard costs.

It is important to have the right amount of coverage while still making it affordable. Had the Johnson’s utilised a financial advisory, this communication could have served as an eye opener to tailor policies best suited for their individual circumstances securing them with the broadest safety net.

Benefits Of Fire Beyond Financial Independence

Insurance gives you more than a sense of financial security; it allows you to live your life without constantly worrying about the things that are out of left field. But instead of worrying about the future, you can focus on your career and spend time with your family while knowing that a safety net is in place to protect yourself against unwanted eventualities.

For the Johnson, it would have meant less stress and greater peace of mind at a difficult time. The presence of insurance can aid in additional access to health care, legal help and all other significant services which will cater for higher quality life

Conclusion: The Road Ahead

Getting insurance for your personal financial plan is akin to getting airbags installed in a car — you may not think about it everyday but thank goodness they are there when we need them. But by assessing your risks, choosing the right policies, and making sure to sonnet yourself with enough coverage in every area you need it on-etc make sure um very good way protect their future. Learn a lesson from the Johnson’s: Do not to wait until you get hit with some financial pothole before realising how important insurance is. Plan your journey today, & fortify way towards a safe and rich future.

FAQ

Personal Finance Note:

That is where a personal financial plan comes in, as it involves working with your money to create some type of strategy that will allow you allocate those resources usefully. All of those includes budgeting, saving, investing and insuring as well. The idea is you want to secure your financial life for now and plan future-wise.

The Three Reasons That Insurance is an Important Element in the Financial Planning Process

When creating a financial plan, I believe insurance is very important as it can save us in case of any sudden events. It insulates your personal finances from costs associated with illness, accidents, property damage or other risks and ensures that unexpected events do not derail your financial well-being.

Which insurances types do I need and photojournalists

Analyse Your Current Financial Position and Identify Weak Spots Some factors can include your health, income, if you have dependants and property/not future city depending on what type of lifestyle you want to maintain. A financial advisory often works in tandem with a consultant to determine what these risks are, and how much insurance you should purchase for each risk – not less (or more) than absolutely necessary.

What Type of Insurance Should You Carry

The level of protection you require is determined by your personal situation. Life insurance: income, debts and the financial needs of your dependent Under health, disability and property insurance consider potential medical expenses coming out of your own pocket; loss of income at the prime age could not have come worse in life so its best to ensure against that risk by including under this heading otherwise you know what happens when change occurs with no prior warning. Look for a financial advisory who can help you find the appropriate coverage levels.

Types of Life Insurance

There are term life insurance and whole life insurance. Term life insurance is coverage that lasts for a certain period, whereas whole life insurance covers you for your entire lifetime and has an investment component. Each type has its benefits and drawbacks for your financial goals and how you expect to use the money.

How do I reduce the car insurance premiums?

In order to reduce your insurance premiums, you can increase the amount of deduction or bundle a few policies with one company for example; credit points are calculated in most countries and a healthy life leads only from there. It helps to review the average costs of your policies every year, and then shop around for competitive rates.

How often should I reassess my insurance coverage?

If you have had a major life change in the last year such as marriage, added another kiddo to your growing family, bought that awesome new home or found yourself with an amazing promotion at work it is beneficial for you and your agent(s) to review all of those policies annually. Periodic reviews help make sure your coverage is still sufficient and fits into your evolving needs and objectives.